The advent of capsule endoscopy has profoundly transformed the field of gastrointestinal diagnostics. The market for capsule endoscopy is witnessing exponential growth, with a valuation of USD 898.48 Million in 2023. Forecasts suggest a significant escalation, from USD 1009.89 Million in 2024 to USD 2572.78 Million by 2032, reflecting a compound annual growth rate (CAGR) of 12.4% from 2025 to 20321.

Recent empirical research has underscored the efficacy of capsule endoscopy. A substantial study involving 607 adults with cirrhosis yielded remarkable outcomes. The dual-sensor magnetically controlled capsule endoscopy (ds-MCE) exhibited a sensitivity of 97.5% and specificity of 97.8% in detecting oesophagogastric varices1.

In the realm of inflammatory bowel disease (IBD) diagnostics, colon capsule endoscopy (CCE) has proven equally efficacious. A meta-analysis encompassing 23 studies and 1353 patients revealed a sensitivity of 92% for both ulcerative colitis and Crohn’s disease. The overall sensitivity for IBD was 90%, with an Area Under the Curve of 0.92, highlighting the technology’s robustness2.

These statistics from the endoscopy market underscore the escalating significance of capsule endoscopy within contemporary gastroenterology. Its non-invasive nature and unparalleled diagnostic precision solidify its status as an indispensable tool for healthcare professionals.

Key Takeaways

- Capsule endoscopy market projected to reach $2.57 billion by 2032

- 12.4% CAGR expected in capsule endoscopy market (2025-2032)

- Dual-sensor MCE shows 97.5% sensitivity for oesophagogastric varices

- Colon capsule endoscopy exhibits 90% overall sensitivity for IBD

- 23 studies with 1353 patients confirm CCE’s effectiveness in IBD diagnosis

- Non-invasive nature enhances patient comfort and diagnostic accuracy

Understanding Capsule Endoscopy Statistics

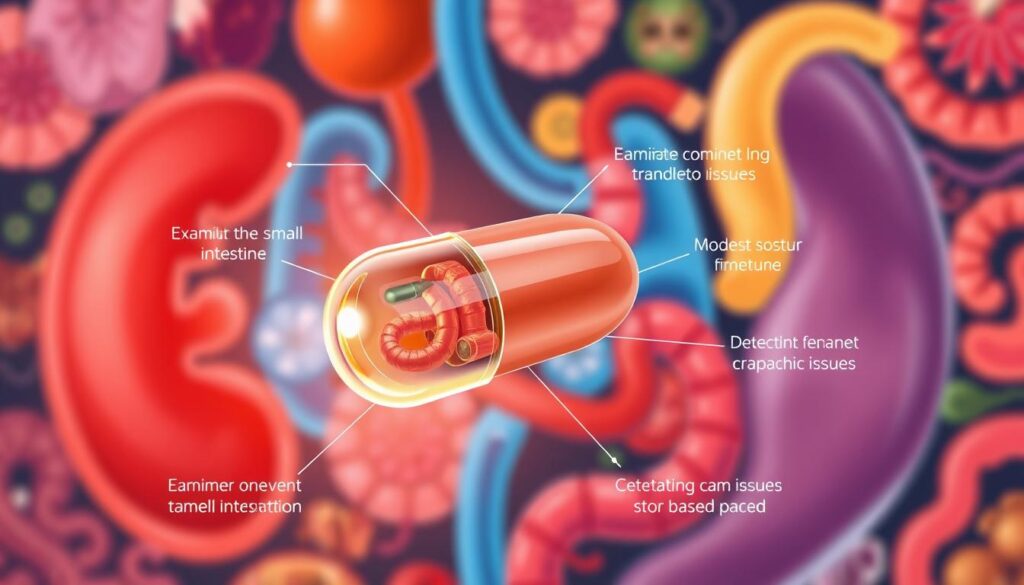

The capsule endoscopy market has witnessed a notable surge in recent years. This cutting-edge technology has transformed gastrointestinal diagnostics, providing a non-invasive means to explore the small intestine.

Global Market Value and Growth Rate

The capsule endoscopy market size is experiencing exponential growth. Forecasts indicate a substantial leap from USD 1009.89 Million in 2024 to USD 2572.78 Million by 2032. This trajectory signifies a compound annual growth rate (CAGR) of 12.4%, underscoring robust endoscopy growth projections3.

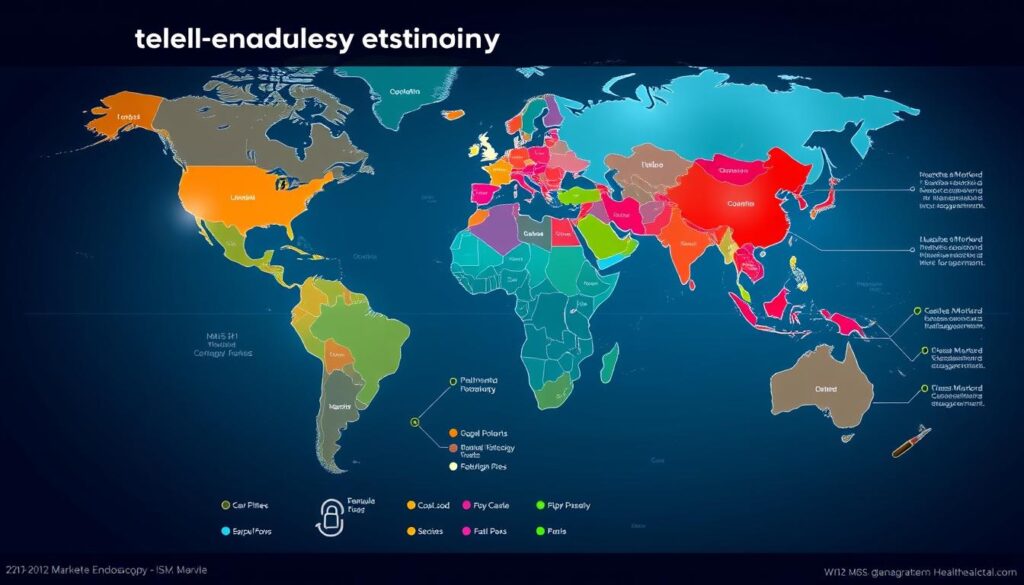

Regional Market Distribution

Capsule endoscopy regional markets exhibit diverse trends. In 2020, North America commanded the largest market share. The Asia Pacific region, on the other hand, is rapidly gaining prominence, with a projected CAGR of 10.3% from 2022 to 20283.

Industry Growth Projections 2024-2032

Endoscopy geographical trends indicate ongoing expansion. The capsule endoscopy market forecast anticipates steady advancement, with a CAGR of 12.4% from 2025 to 2032. This expansion is fueled by technological innovations and increasing clinical adoption3.

| Year | Market Value (USD Million) | Growth Rate |

|---|---|---|

| 2024 | 1009.89 | – |

| 2028 | 1612.57 | 12.4% |

| 2032 | 2572.78 | 12.4% |

Future trends in capsule endoscopy include enhanced imaging capabilities and AI integration. The industry is on the cusp of further innovation, with devices like the PillCam SB 3 receiving FDA clearance in August 20213. These advancements are anticipated to propel market growth and enhance diagnostic precision in gastrointestinal disorders.

Evolution of Capsule Endoscopy Technology

The advent of capsule endoscopy technology in the medical field represents a groundbreaking achievement. This evolution, from the inception of the M2A device to the current state of capsule technology, exemplifies the profound advancements in endoscopy.

From M2A to Modern Devices

In 2001, the Food and Drug Administration sanctioned the use of capsule endoscopy, ushering in a new era for gastrointestinal imaging4. Initially, patients were encumbered by cumbersome equipment. Yet, with the advent of Medtronic’s PillCam™ SB 3, this burden has been significantly alleviated, transforming into a discreet adhesive worn under attire4. Such progress has not only elevated patient comfort but also broadened the scope of therapeutic interventions.

Technical Specifications Development

The specifications of contemporary capsule endoscopy have undergone a transformative evolution. Presently, these devices are capable of capturing detailed images spanning 20 to 22 feet of the small intestine with unparalleled clarity4. This significant enhancement in device capabilities has significantly bolstered diagnostic precision and streamlined patient care processes.

Innovation Timeline 2000-2024

The trajectory of capsule endoscopy innovations spans nearly two decades. Notable milestones in endoscopy technology include:

| Year | Innovation |

|---|---|

| 2000 | Clinical introduction of capsule endoscopy |

| 2001 | FDA approval of first commercial device |

| 2024 | AI integration with 87.17% accuracy in lesion detection5 |

Recent breakthroughs include the integration of AI, which processes frames at a rate of 75.04 per second and identifies 12 distinct categories of small bowel lesions5. These advancements continue to redefine the frontiers of gastrointestinal diagnostics and therapeutic modalities.

Clinical Applications and Success Rates

Introduced in 2000, capsule endoscopy has revolutionized gastrointestinal diagnostics, enabling non-invasive exploration of the small bowel6. The PillCam™ SB, a cornerstone in diagnosing obscure GI bleeding and Crohn’s disease, captures images at a rate of up to 6 per second6. This innovation has been instrumental in managing acute gastrointestinal bleeding, proving invaluable in resource-constrained settings during the COVID-19 pandemic7.

The efficacy of endoscopy is underscored by a complete examination rate (CR) of 83.0% for pill capsule endoscopy (PCE)6. The CC-CLEAR scale, akin to the Boston Bowel Preparation Scale, evaluates colon cleanliness, with scores ranging from inadequate (0-5) to excellent (8-9)6. A systematic review revealed an adequate cleansing rate (ACR) of 72.5%, underscoring the significance of thorough bowel preparation6.

Introduced in 2017 and 2023, double-headed capsules such as PillCam™ Crohn’s and OMOM CCTM enable continuous image acquisition throughout the examination6. These devices are predominantly employed for monitoring Crohn’s disease and investigating gastrointestinal bleeding6. The average time required for PCE readings is up to 120 minutes, reflecting the exhaustive nature of the examination6.

| Capsule Type | Frame Rate | Primary Use |

|---|---|---|

| PillCam™ SB | Up to 6 images/second | Obscure GI bleeding, Crohn’s disease |

| PillCam™ COLON 2 | Up to 35 images/second | Colon examination |

| Double-headed capsules | Continuous acquisition | Crohn’s disease, GI bleeding |

Wireless Capsule Endoscopy (WCE) devices, measuring 11×26 mm, incorporate lenses, image sensors, LED lights, batteries, and antennas7. These devices transmit images wirelessly to a receiver attached to the patient, facilitating real-time lesion identification7. Standard batteries in WCE systems power devices for approximately 8–10 hours, operating at a power rating of 20 mW and a voltage of 3V7.

Market Segmentation Analysis

The capsule endoscopy market exhibits a plethora of segments, reflecting its extensive applications and end-users. This examination delves into product types, end-user statistics, and application-wise market share. It provides insights into market dynamics and growth trends, shedding light on the industry’s evolution.

Product Type Distribution

Capsule endoscopy product types dominate the endoscopy market segments. The capsule endoscopes segment led the market with a 75.7% share in 2020, underscoring its critical role in gastrointestinal diagnostics. The global endoscopy devices market, valued at USD 61.06 billion in 2024, is projected to grow at a 3.79% CAGR from 2025 to 20308. This growth is partly driven by the increasing prevalence of gastrointestinal diseases and an aging population prone to chronic conditions like colon cancer and diverticulitis9.

End-user Statistics

Capsule endoscopy end-users span various healthcare settings. Hospitals emerged as the dominant segment in the Capsule Endoscopy System market9. This dominance is attributed to hospitals’ focus on improving patient care, efficiency, and accurate diagnoses through innovative technologies. The endoscopy market demographics show a rising demand, with approximately 16% of the U.S. population aged above 65 years in 2019, expected to reach 21.6% by 20408.

Application-wise Market Share

The capsule endoscopy applications market is diverse, addressing various gastrointestinal conditions. The OGIB (Obscure Gastrointestinal Bleeding) segment held the largest revenue share at 58.1% in 2020, underscoring the technique’s benefits in OGIB diagnosis and detection. The endoscopy procedure distribution is influenced by the rising incidence of gastrointestinal cancers. In 2022, an estimated 106,180 cases of colon cancer, 44,850 cases of rectal cancer, and 26,380 cases of stomach cancer occurred in the U.S8.

| Market Segment | Key Statistic | Year |

|---|---|---|

| Capsule Endoscopes | 75.7% market share | 2020 |

| Global Endoscopy Devices | USD 61.06 billion market size | 2024 |

| OGIB Applications | 58.1% revenue share | 2020 |

The market segmentation analysis reveals a robust growth trajectory for capsule endoscopy, driven by technological advancements and increasing healthcare needs. As the population ages and the incidence of gastrointestinal diseases rises, the demand for innovative endoscopic solutions is expected to surge. This will reshape the landscape of digestive health diagnostics and treatment.

Geographical Market Distribution and Trends

The capsule endoscopy global market exhibits a complex tapestry of regional dynamics, with North America holding the preeminent position. In 2020, North America asserted its dominance, commanding the largest market share, a testament to its sophisticated healthcare infrastructure10. The region’s leadership is further underscored by the staggering 75 million endoscopies conducted annually, with a remarkable 68% dedicated to gastrointestinal procedures10.

Europe occupies the second tier in market share, while the Asia Pacific region is rapidly ascending, driven by burgeoning demand and technological innovation11. The Asia Pacific market is forecasted to exhibit a robust CAGR of 10.3% from 2022-2028, underscoring a significant upswing in adoption and technological advancements10.

The global capsule endoscopy market, currently valued at USD 515.89 Million in 2023, is anticipated to ascend to USD 1081.73 Million by 2031, with a projected CAGR of 9.91% from 2024 to 203111. This anticipated expansion is fueled by the escalating prevalence of digestive diseases, with approximately 60 to 70 million individuals in the United States alone grappling with such afflictions12.

| Region | Market Share (2020) | Growth Projection |

|---|---|---|

| North America | Largest | Steady growth |

| Europe | Second largest | Moderate growth |

| Asia Pacific | Emerging market | Highest CAGR (10.3%) |

The trajectory of endoscopy regional trends indicates a burgeoning acceptance of capsule endoscopy technology globally. The technology’s introduction has precipitated over 2 million capsule endoscopy procedures worldwide, underscoring its widespread integration into clinical practice12. This trend is anticipated to persist, buoyed by escalating awareness and enhancements in healthcare infrastructure across various regions.

Healthcare Impact and Patient Outcomes

Capsule endoscopy has transformed gastrointestinal diagnostics, achieving unparalleled accuracy and significantly improving patient experiences. This discourse delves into the diagnostic precision, patient satisfaction, and clinical success rates of this groundbreaking technology.

Diagnostic Accuracy Rates

Capsule endoscopy exhibits extraordinary accuracy in identifying small bowel anomalies. A study involving 8,401 patients undergoing small bowel capsule endoscopy (SBCE) for small bowel bleeding investigation reported a diagnostic yield of 43.5% for antithrombotic users and 18.9% for non-users13. This disparity (p

Patient Satisfaction Metrics

The capsule endoscopy patient experience is predominantly favorable due to its non-invasive nature. A pediatric study documented that 99.74% of 1,143 children successfully completed the procedure, with 75.79% able to swallow the capsule orally14. These figures underscore the procedure’s simplicity and patient comfort across various age groups.

Clinical Success Statistics

Capsule endoscopy clinical outcomes are noteworthy. The procedure achieved a 90.3% rate of complete small bowel examination13. For specific conditions, such as gastrointestinal bleeding with negative upper and lower endoscopic examinations, small-bowel capsule endoscopy is deemed medically necessary15. These high success rates contribute to enhanced patient management and outcomes.

| Metric | Value |

|---|---|

| Overall Diagnostic Yield | 26.4% |

| Complete Small Bowel Examination Rate | 90.3% |

| Pediatric Completion Rate | 99.74% |

| Average Small Bowel Transit Time | 254.9 ± 109.1 minutes |

These statistics underscore the profound impact of capsule endoscopy on healthcare outcomes. It combines high endoscopy diagnostic precision with positive patient experiences and robust clinical success rates.

Cost Analysis and Healthcare Economics

The economic framework of capsule endoscopy is intricately complex, with costs fluctuating significantly based on procedure type and geographical location. Capsule endoscopy expenses typically fall within the range of $1,200 to $2,500, often surpassing traditional methodologies due to its cutting-edge technology16. This elevated pricing reflects the procedure’s innovative essence and its enhanced diagnostic precision capabilities.

An examination of the endoscopy economic impact necessitates a consideration of both direct and indirect expenditures. Direct costs for endoscopic procedures can range from $1,000 to $3,000, influenced by geographical location and facility fees16. Urban healthcare settings typically incur costs 30% to 50% higher than their rural counterparts16.

The economic benefits of capsule endoscopy transcend immediate expenditures. Early detection and treatment via endoscopy can lead to a reduction in overall healthcare costs by up to 40% when diseases are identified at their initial stages16. This substantial cost-saving highlights the long-term economic benefits of investing in advanced endoscopic technologies.

Capsule endoscopy also exhibits promising clinical outcomes. Research indicates that colon capsule endoscopy (CCE) boasts a sensitivity of 79.2% and specificity of 96.3% for polyps ≥6 mm, surpassing CT colonography17. These enhanced diagnostic capabilities can lead to more streamlined patient care and potentially diminish the necessity for additional, costly procedures.

From an environmental standpoint, capsule endoscopy presents advantages. Traditional endoscopic examinations generate approximately 28 kg of CO2 equivalent per procedure18. CCE is anticipated to reduce the number of colonoscopy procedures by about 30% for colorectal cancer screening, potentially leading to significant reductions in healthcare-related carbon emissions18.

As the healthcare sector strives for net-zero carbon emissions by 2050, the integration of technologies like capsule endoscopy could be instrumental in achieving this goal18. This dual focus on patient care and environmental stewardship exemplifies the evolving healthcare economics landscape in the 21st century.

Technological Advancements and Future Projections

The realm of capsule endoscopy is witnessing an exponential leap in technological sophistication, propelled by the integration of artificial intelligence and the advent of novel designs. These innovations are fundamentally altering the landscape of diagnostic capabilities and the dynamics of the market.

AI Integration Statistics

The incorporation of capsule endoscopy AI is transforming the field of gastrointestinal diagnostics. Research indicates that AI systems can achieve up to 99% sensitivity and specificity in the detection of gastrointestinal bleeding19. A CADe system has demonstrated a 99% F1 score in bleeding detection, utilizing 10,000 WCE images19. AI-assisted diagnostics have the capability to reduce the time required for reading small-bowel abnormalities from 96.2 minutes to a mere 5.9 minutes19.

Innovation Trends

Artificial intelligence in endoscopy is significantly improving the detection and characterization of polyps. CADe systems have been shown to enhance adenoma detection rates, with particular efficacy in identifying diminutive or flat adenomas19. CADx technology boasts a 90.9% sensitivity in polyp characterization, surpassing the 48.1% accuracy without AI19. These advancements in capsule endoscopy are poised to revolutionize diagnostic precision and efficiency.

Future Market Predictions

The endoscopy future technologies market is anticipated to experience substantial expansion. The global endoscopy devices market, valued at $5.95 billion in 2021, is forecasted to reach $10.55 billion by 2030, with a projected CAGR of 6.17%20. The capsule endoscopy market is expected to witness a surge in demand for disposable endoscopes, with an anticipated increase of $6 billion by 203020. Industry projections indicate a shift towards single-use devices, with revenue growth from 17% to 69% between October 2020 and March 202120.

| Market Segment | 2021 Value | 2030 Projection | CAGR |

|---|---|---|---|

| Global Endoscopy Devices | $5.95 billion | $10.55 billion | 6.17% |

| North America Endoscopy Devices | $11.52 billion | $20.62 billion | 6.68% |

| Endoscopes | $11.54 billion | $19.50 billion | 6.00% |

Conclusion

Capsule endoscopy has transformed gastrointestinal diagnostics, marking its inception in 2001. The endoscopy industry’s trajectory, characterized by exponential growth and technological leaps, is a testament to its transformative impact. A study involving 22 gastroenterologists from 11 Danish hospitals underscored the significance of experience in capsule endoscopy interpretation, revealing a sensitivity increase from 65% to 67% after the first 20 procedures21.

The future of capsule endoscopy appears promising, with its integration into healthcare systems gaining momentum. Recent systematic reviews have scrutinized its diagnostic efficacy for inflammatory bowel diseases, employing sophisticated statistical methodologies. These analyses, which included bivariate logistic regression models, aimed to derive pooled estimates of sensitivity, specificity, and predictive values22.

Advancements in the field are expected to enhance diagnostic precision and patient outcomes. The European Society for Gastrointestinal Endoscopy advocates for a minimum of 75 to 100 small bowel capsule endoscopies annually for a center. The American Society for Gastrointestinal Endoscopy, on the other hand, recommends at least 20 supervised procedures before independent practice21. These recommendations highlight the imperative for ongoing education and training in this rapidly evolving discipline.

In summary, capsule endoscopy has emerged as a vital tool in gastrointestinal diagnostics. Its future prospects are auspicious, with ongoing technological innovations and expanding clinical applications. The endoscopy industry’s trajectory suggests that capsule endoscopy will continue to be a cornerstone in advancing gastrointestinal care and elevating patient outcomes in the forthcoming years.

FAQ

What is the current global market value of capsule endoscopy?

Which regions dominate the capsule endoscopy market?

What are the main types of capsule endoscopes available in the market?

How has capsule endoscopy technology evolved?

What are the primary clinical applications of capsule endoscopy?

How does the diagnostic accuracy of capsule endoscopy compare to traditional methods?

What is the impact of artificial intelligence on capsule endoscopy?

What are the future projections for the capsule endoscopy market?

Source Links

- Diagnostic accuracy of magnetically guided capsule endoscopy with a detachable string for detecting oesophagogastric varices in adults with cirrhosis: prospective multicentre study – https://pmc.ncbi.nlm.nih.gov/articles/PMC10912951/

- The Diagnostic Accuracy of Colon Capsule Endoscopy in Inflammatory Bowel Disease—A Systematic Review and Meta-Analysis – https://pmc.ncbi.nlm.nih.gov/articles/PMC11431635/

- Wireless Capsule Endoscopy for Gastrointestinal (GI) Disorders – https://beonbrand.getbynder.com/m/7b1bbe6ba32e69f0/original/Wireless-Capsule-Endoscopy-for-Gastrointestinal-GI-Disorders.pdf

- UHealth First in the World to Deploy New Endoscopy Technology for Small Bowel Imaging – InventUM – https://news.med.miami.edu/uhealth-first-in-the-world-to-deploy-new-endoscopy-technology-for-small-bowel-imaging/

- Establishing an AI model and application for automated capsule endoscopy recognition based on convolutional neural networks (with video) – BMC Gastroenterology – https://bmcgastroenterol.biomedcentral.com/articles/10.1186/s12876-024-03482-7

- Capsule endoscopy and panendoscopy: A journey to the future of gastrointestinal endoscopy – https://pmc.ncbi.nlm.nih.gov/articles/PMC11000081/

- Robotic wireless capsule endoscopy: recent advances and upcoming technologies – Nature Communications – https://www.nature.com/articles/s41467-024-49019-0

- Endoscopy Devices Market Size And Share Report, 2030 – https://www.grandviewresearch.com/industry-analysis/endoscopy-devices-market

- Capsule Endoscopy System Market To Reach USD 698.91 Billion By Year 2032 – https://introspectivemarketresearch.com/press-release/capsule-endoscopy-system-market/

- Capsule Endoscopy Market Report: Size, Share & Forecast | 2032 – https://www.skyquestt.com/report/capsule-endoscopy-market

- Global Capsule Endoscopy Market Size, Share, Growth and Forecast to 2031 – https://www.insightaceanalytic.com/report/global-capsule-endoscopy-market/1086

- Capsule Endoscopy Market Size, Share, Trends & Forecast – https://www.verifiedmarketresearch.com/product/capsule-endoscopy-market/

- Diagnostic Yield and Outcomes of Small Bowel Capsule Endoscopy in Patients with Small Bowel Bleeding Receiving Antithrombotics – https://pmc.ncbi.nlm.nih.gov/articles/PMC11240733/

- Frontiers | Clinical assessment of small bowel capsule endoscopy in pediatric patients – https://www.frontiersin.org/journals/medicine/articles/10.3389/fmed.2024.1455894/full

- PDF – https://www.providencehealthplan.com/-/media/providence/website/pdfs/providers/medical-policy-and-provider-information/medical-policies/mp134.pdf

- Endoscopy Cost-Benefit Analysis: Value of Diagnostic Precision – https://curasia.com/endoscopy-cost-benefit-analysis-weighing-the-value-of-diagnostic-precision/

- PDF – http://mcgs.bcbsfl.com/MCG?mcgId=01-91000-05&pv=false

- Colon capsule endoscopy: Can it contribute to green endoscopy? – https://pmc.ncbi.nlm.nih.gov/articles/PMC11669966/

- As how artificial intelligence is revolutionizing endoscopy – https://e-ce.org/journal/view.php?number=7857

- Endoscopy Devices Market Size & Demand Analysis | 2030 – https://straitsresearch.com/report/endoscopy-devices-market

- More than 20 procedures are necessary to learn small bowel capsule endoscopy: Learning curve pilot study of 535 trainee cases – https://pmc.ncbi.nlm.nih.gov/articles/PMC11136552/

- The Diagnostic Accuracy of Colon Capsule Endoscopy in Inflammatory Bowel Disease—A Systematic Review and Meta-Analysis – https://www.mdpi.com/2075-4418/14/18/2056